Everything about Estate Planning Attorney

Everything about Estate Planning Attorney

Blog Article

The 7-Minute Rule for Estate Planning Attorney

Table of ContentsUnknown Facts About Estate Planning AttorneyExcitement About Estate Planning AttorneyAbout Estate Planning AttorneyThe Ultimate Guide To Estate Planning Attorney

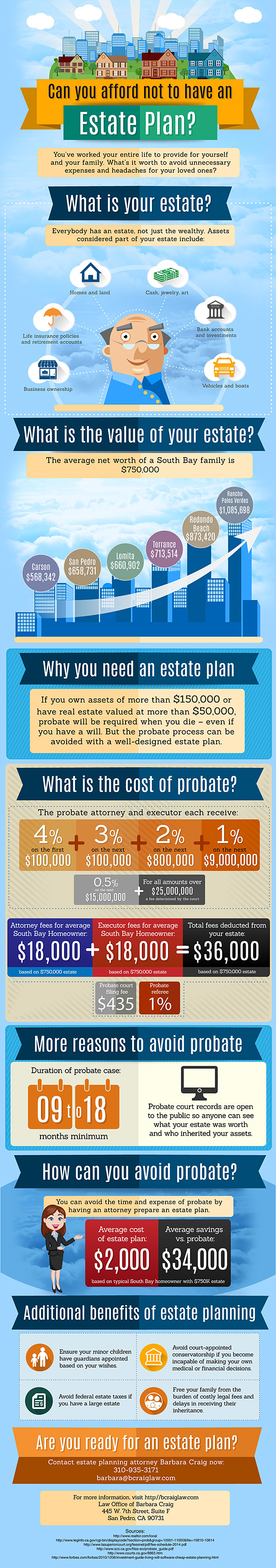

Estate preparation is an action plan you can make use of to establish what takes place to your possessions and obligations while you live and after you die. A will, on the various other hand, is a lawful document that details how properties are distributed, who deals with children and pet dogs, and any kind of other desires after you pass away.

The executor likewise needs to pay off any type of tax obligations and financial obligation owed by the deceased from the estate. Financial institutions normally have a minimal quantity of time from the date they were alerted of the testator's death to make insurance claims versus the estate for cash owed to them. Claims that are denied by the administrator can be brought to justice where a probate judge will have the final say regarding whether or not the case stands.

How Estate Planning Attorney can Save You Time, Stress, and Money.

After the stock of the estate has been taken, the value of assets calculated, and tax obligations and debt repaid, the administrator will certainly then seek authorization from the court to distribute whatever is left of the estate to the recipients. Any type of estate taxes that are pending will certainly come due within 9 months of the date of fatality.

Each specific places their properties in the depend on and names someone various other than their partner as the recipient. However, A-B counts on have actually become less popular as the inheritance tax exception functions well for a lot of estates. Grandparents might transfer assets to an entity, such as a 529 plan, to support grandchildrens' education.

Estate Planning Attorney Can Be Fun For Everyone

This approach includes cold the worth of an asset at its value on the day of transfer. Accordingly, the quantity of possible funding gain at fatality is also iced up, permitting websites the estate organizer to estimate their prospective tax obligation upon fatality and better plan for the repayment of revenue taxes.

If adequate insurance coverage proceeds are readily available and the plans are properly structured, any type of earnings tax on the regarded personalities of assets complying with the death of a person can be paid without resorting to the sale of assets. Proceeds from life insurance policy that are received by the recipients upon the fatality of the guaranteed are normally income tax-free.

There are certain files you'll require as component of the estate planning process. Some of the most usual ones consist of wills, powers of lawyer (POAs), guardianship designations, and living wills.

There is a misconception that estate planning is just for high-net-worth people. Estate preparing makes it less complicated for individuals to identify their wishes prior to and after they pass away.

The 5-Minute Rule for Estate Planning Attorney

You should start Visit This Link planning for your estate as quickly as you have any quantifiable asset base. It's a recurring process: as life progresses, your estate strategy ought to move to match your conditions, in line with your new goals.

Estate planning is typically considered a device for the affluent. Yet that isn't the instance. It can be a beneficial method for you to handle your possessions and obligations before and after you pass away. Estate preparation is likewise a wonderful way for you to set out prepare for the care of your small kids and animals and to describe your long for your funeral service and preferred charities.

Applications have to be. Eligible applicants that pass the exam will certainly be officially accredited in August. If you're qualified to sit for the test from a previous application, you might submit link the brief application. According to the guidelines, no certification shall last for a duration longer than 5 years. Discover when your recertification application schedules.

Report this page